What is a SDIRA Custodian Checklist?

A SDIRA custodian checklist outlines the essential steps needed to initiate self-directed investing through a custodian. It serves as a comprehensive guide, ensuring individuals adhere to regulatory requirements and efficiently navigate the process. From account setup to investment selection, this checklist delineates crucial actions to take, offering clarity and structure for investors venturing into self-directed IRAs.

How to Begin Self-Directed Investing with SDIRA Custodian?

Starting self-directed investing with a SDIRA custodian involves several key steps. First, individuals must choose a reputable custodian that supports self-directed accounts. Next, they’ll need to open a self-directed IRA with the chosen custodian and fund the account. Once the account is established, investors can explore various investment opportunities permitted within the self-directed IRA framework, such as real estate, precious metals, private equity, and more.

Why Use a Checklist for SDIRA Custodian Setup?

Utilizing a checklist for sdira custodian setup offers numerous benefits. It ensures thoroughness and compliance with regulatory guidelines, reducing the risk of oversight or errors during the process. Additionally, a checklist provides a clear roadmap, streamlining the setup procedure and minimizing confusion for investors. By following a structured checklist, individuals can feel confident in their decisions and investments, ultimately maximizing the potential of their self-directed IRA journey.

Tips for Streamlining Your SDIRA Custodian Setup Process

To streamline the SDIRA custodian setup process, consider several helpful tips. Research custodians thoroughly to find one that aligns with your investment goals and preferences. Prepare all necessary documentation and information in advance to expedite the account opening process. Communicate clearly with the custodian and seek assistance whenever needed. Stay organized and maintain regular communication to ensure a smooth setup experience. Lastly, remain patient and diligent throughout the process, as proper setup is crucial for successful self-directed investing.

Types of Investments for Self-Directed IRA Custodians

Self-directed IRA custodians allow a wide range of investment options beyond traditional assets like stocks and bonds. Common investment types include real estate, precious metals, private equity, private loans, tax liens, and more. Each investment type offers unique benefits and considerations, allowing investors to diversify their portfolios and pursue alternative avenues for wealth accumulation. With the flexibility provided by self-directed IRAs, individuals can explore various investment opportunities tailored to their financial objectives and risk tolerance.

Setup Self-Directed IRA: Key Steps with Custodian

Setting up a self-directed IRA involves several key steps, with selecting a custodian being paramount. Firstly, research and choose a reputable custodian who offers self-directed IRA services. Next, open an account with the chosen custodian, providing necessary personal information and funding the account. Then, familiarize yourself with the investment options available within a self-directed IRA, such as real estate, precious metals, or private equity. Once you’ve determined your investment strategy, work closely with your custodian to execute transactions and manage your account securely. Regularly review your investments and consult with financial professionals to ensure your self-directed IRA aligns with your long-term financial goals.

SDIRA Custodian’s Role in Your Investment Journey

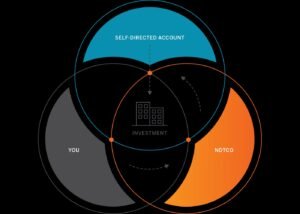

The SDIRA custodian plays a pivotal role in guiding and safeguarding your investment journey. Serving as a trustee, they ensure compliance with IRS regulations and oversee transactions within your self-directed individual retirement account (SDIRA). Their expertise aids in navigating complex investment landscapes, offering valuable insights to help diversify your portfolio effectively. Additionally, custodians facilitate administrative tasks, such as processing contributions, distributions, and maintaining records. Beyond administrative duties, they act as a resource, providing education and guidance to help investors make informed decisions aligned with their financial goals. With their support, investors can confidently navigate the complexities of SDIRA investing, maximizing opportunities while mitigating risks.

Top Errors in Self-Directed Investing via Custodian

Self-directed investing via a custodian can be empowering, yet it also presents pitfalls. One common error is insufficient diversification, as investors may concentrate too heavily on specific assets, exposing themselves to unnecessary risk. Another misstep is inadequate research, where investors fail to thoroughly understand the assets they’re investing in, leading to poor decisions. Emotional trading ranks among the top errors, as investors may panic-sell during market downturns or chase after hot trends, disregarding long-term strategies. Lastly, neglecting to regularly review and adjust investment portfolios can result in missed opportunities or prolonged exposure to underperforming assets. Vigilance and discipline are key to navigating these challenges successfully.

Conclusion

Navigating the world of self-directed investing with a SDIRA custodian demands meticulous planning and adherence to regulatory frameworks. By following a comprehensive checklist, investors can confidently initiate and manage their self-directed IRA accounts, leveraging a diverse range of investment opportunities. Continuous education, prudent decision-making, and regular portfolio reviews are crucial for long-term success. With the right approach, investors can harness the flexibility of self-directed IRAs to tailor their portfolios to their financial goals while maximizing potential returns. Diligence and strategic execution pave the way for a rewarding journey in self-directed investing with SDIRA custodians.